Tax-Deductible Donations: Charitable Giving in Denver and Its Tax Benefits

Why Charitable Giving Matters in Denver

Why Charitable Giving Matters in Denver

Charitable donations are the lifeblood of Denver’s nonprofit community. They fund essential programs like child care services and homeless shelters, creating a lasting positive impact on the city. Beyond the social good, these donations also offer tangible financial rewards for donors through tax benefits. Why do you need tax-deductible donations in Denver?

The Importance of Understanding Tax Benefits

Many Denver residents and businesses miss out on substantial savings by not fully utilizing available tax credits and deductions. Colorado offers unique incentives, such as the Child Care Contribution Credit and the Homeless Contribution Tax Credit, that make giving back even more rewarding. Navigating these programs can help maximize your contribution and tax savings.

What You’ll Learn in This Article

What You’ll Learn in This Article

- An overview of Colorado’s charitable tax benefits and how they compare to federal incentives.

- A deep dive into crucial tax credit programs like Child Care and Homeless Contribution Tax Credit.

- Deduction limits for high-income earners and tips for navigating them.

- Documentation requirements to ensure compliance and avoid tax issues.

- Strategies for maximizing your tax savings while supporting local causes.

By the end of this guide, you’ll have all the tools you need to make informed, impactful donations while enjoying significant tax advantages.

Tax Benefits for Charitable Donations in Colorado

Tax Benefits for Charitable Donations in Colorado

Why Colorado Stands Out for Charitable Giving

Colorado is one of the most donor-friendly states regarding tax benefits. Donors can make a meaningful impact with specific tax credit programs and generous deductions while reducing their tax liability.

State and Federal Tax Benefits Explained

Charitable donations are eligible for both state and federal tax benefits:

- Federal Deductions: Itemized deductions allow donors to lower their taxable income.

- Colorado Tax Credits: State-specific credits, such as the Child Care Contribution Credit and Homeless Contribution Tax Credit, directly reduce the amount of state taxes owed.

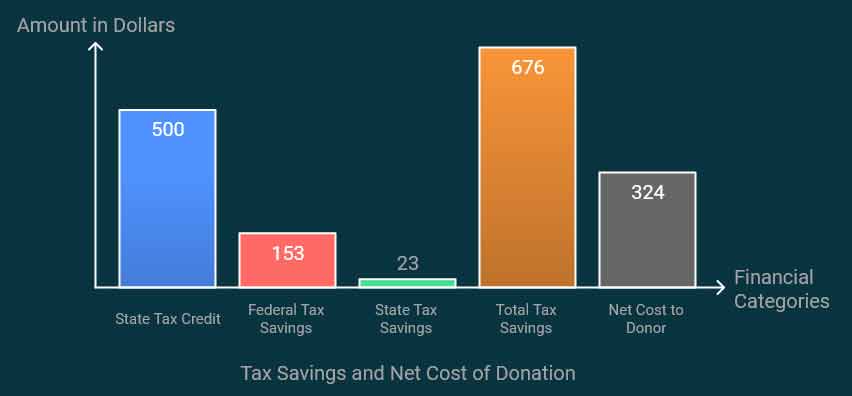

Example: A $1,000 donation under the Child Care Contribution Credit can result in $676 in total tax savings when combining state and federal benefits.

The Role of Charitable Donations in Supporting Denver’s Community

- Local Organizations: Donations fund essential services such as food banks, educational programs, and housing for people experiencing homelessness.

- Community Growth: Contributions foster a stronger, more connected Denver by supporting underprivileged communities.

- Nonprofit Sustainability: Your donations ensure local nonprofits can continue their mission-driven work.

“Every dollar donated goes further in Colorado, thanks to programs that reward generosity with significant tax credits.”

Tax Deduction Benefits for Donations to Goodwill, ARC, Habitat for Humanity, and Salvation Army

Donating to reputable organizations like Goodwill, ARC Thrift Stores, Habitat for Humanity, and Salvation Army may qualify for valuable tax deductions. Here’s how these deductions work and how to maximize your benefits:

Eligibility for Tax Deductions

- Donations must be made to qualified 501(c)(3) nonprofit organizations.

- Items must be in good or better condition to qualify for a tax deduction.

- Keep receipts or written acknowledgment from the organization to document your contribution.

How to Claim a Deduction

- Itemize Your Deductions: Only taxpayers who itemize deductions on their federal return can claim charitable contributions.

- Determine Fair Market Value: The IRS allows you to deduct the fair market value of your donated items, which is the price they would sell for in their current condition.

- Special Rules for Donations of $500 or More: If the total value of non-cash donations exceeds $500, you must file Form 8283 with your tax return.

What You Can Deduct

- Clothing and Household Goods: Estimate their resale value based on thrift store pricing.

- Furniture and Appliances: Deduct the fair market value; for items over $5,000, you’ll need a qualified appraisal.

- Vehicles: Deduction depends on whether the organization sells or uses the car directly.

Example Tax Savings

If you donate clothing worth $1,000 to Goodwill:

- At a 22% federal tax rate, you could save $220 on your taxes.

Documentation Requirements

- For All Donations: Keep receipts showing the donated items’ date, organization, and description.

- For Contributions ≥ $250: Obtain a written acknowledgment specifying whether you received any goods or services in return.

Donating to these organizations supports impactful missions and reduces your taxable income, making your generosity even more rewarding.

Major Tax Credit Programs in Colorado

Major Tax Credit Programs in Colorado

3.1. Child Care Contribution Credit: A 50% Tax Benefit

Overview of the Program and Its Benefits

The Child Care Contribution Credit offers a 50% tax credit on donations made to qualified childcare programs in Colorado. This substantial credit is available to individuals and businesses, encouraging widespread participation in supporting early childhood education.

Eligibility Requirements

- Donations must be monetary and fully paid via cash, check, credit card, or electronic transfer.

- Both individual and corporate donors are eligible.

- Excess credits can be carried forward for up to five years, ensuring flexibility.

Example of Tax Savings

Let’s calculate the savings for a $1,000 donation:

- State Tax Credit: $500

- Federal Tax Savings: $153

- State Tax Savings: $23

- Total Tax Savings: $676

- Net Cost to Donor: $324

Key Dates and Guidelines

- Valid through tax years 2018–2024.

- Donations must be made to state-approved childcare organizations.

Homeless Contribution Tax Credit: A 25% Tax Relief

Homeless Contribution Tax Credit: A 25% Tax Relief

Details of the Program

The Homeless Contribution Tax Credit provides a 25% tax credit for donations to qualified homeless programs. This credit applies to monetary and in-kind contributions of $5,000 or more, such as stock.

Eligibility Requirements

- Monetary gifts of any amount qualify.

- Donations of stock or other non-cash assets must meet the $5,000 threshold.

- Credits cannot be claimed through donor-advised funds or workplace giving programs.

How to Claim the Credit

- Ensure your donation meets eligibility criteria.

- File your taxes electronically to claim the credit.

- Keep detailed documentation, including the organization’s acknowledgment of your contribution.

Example Scenario

Donor A contributes $10,000 in appreciated stock to a homeless shelter. They receive a $2,500 state tax credit and avoid capital gains taxes, maximizing their savings.

“Giving back to homeless programs not only changes lives but also offers one of the most generous tax incentives in Colorado.”

Deduction Limitations for High-Income Earners

Deduction Limitations for High-Income Earners

Understanding Deduction Caps for High-Income Taxpayers

Colorado imposes specific limitations on itemized deductions for taxpayers with federal adjusted gross incomes (AGI) of $400,000 or more:

- Single Filers: Deductions are capped at $30,000.

- Joint Filers: Deductions are capped at $60,000.

These caps limit the tax relief high-income earners can claim, impacting their ability to deduct charitable donations fully.

Challenges for High-Income Taxpayers

- Reduced Tax Savings: The caps restrict the value of deductions, making it difficult to offset charitable contributions fully.

- Federal vs. State Discrepancies: Federal rules often allow more significant deductions, but state limits can significantly reduce the overall benefit.

- Complexity in Tax Planning: Navigating different thresholds and rules adds to the complexity of optimizing tax benefits.

Strategies to Maximize Deductions

High-income taxpayers can adopt these strategies to optimize their charitable giving:

- Bundle Donations: Combine multiple years’ contributions into a single tax year to exceed deduction thresholds.

- Utilize Tax Credits: Focus on programs like the Child Care Contribution Credit or Homeless Contribution Tax Credit, which provide direct tax savings without being subject to deduction caps.

- Donate Appreciated Assets: Contribute stocks or other appreciated assets to avoid capital gains taxes and claim deductions based on fair market value.

- Consider Donor-Advised Funds: Make a single large donation to a donor-advised fund. This allows immediate tax benefits while distributing funds to charities over time.

Navigating Federal and State Differences

Federal tax laws often permit more generous deductions compared to state rules. Here’s how to address the differences:

- Focus on Federal Benefits: Maximize deductions at the federal level by donating to qualified organizations and itemizing contributions.

- Leverage Colorado Credits: Use state tax credits to offset tax liability, bypassing deduction limitations.

- Consult a Tax Professional: Work with experts to effectively balance federal and state tax strategies.

“High-income taxpayers can still make a significant charitable impact by leveraging strategic giving methods to maximize tax benefits.”

Documentation Requirements for Charitable Contributions

Documentation Requirements for Charitable Contributions

5.1 General Requirements

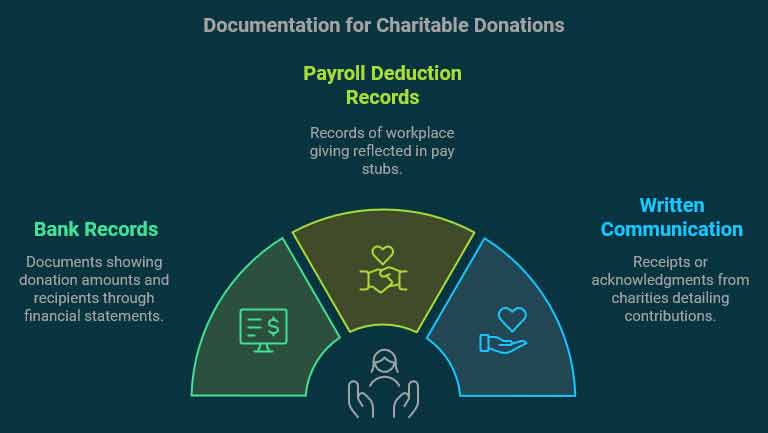

Why Documentation Matters

Proper documentation is essential for claiming tax benefits on charitable donations. The IRS and the Colorado Department of Revenue require clear records to verify contributions. Failing to maintain accurate records can result in denied deductions or penalties.

Required Documentation for All Donations

- Bank Records: Canceled checks or bank statements showing the donation amount and recipient.

- Payroll Deduction Records: Pay stubs or employer-provided documentation for workplace giving.

- Written Communication: A receipt or acknowledgment from the charity, including:

- Organization name.

- Date of the contribution.

- Amount donated.

Tips for Keeping Accurate Records

- Organize donation receipts in a dedicated file or digital folder.

- Use tax software or apps to track contributions throughout the year.

- Request documentation immediately after donating.

5.2 Special Documentation Rules for Donations of $250 or More

5.2 Special Documentation Rules for Donations of $250 or More

Additional Requirements for Larger Donations

For donations of $250 or more, the IRS mandates a written acknowledgment from the charity. This acknowledgment must include:

- The exact amount of cash or a description of donated property.

- A statement clarifying whether any goods or services were received in exchange.

- A description and estimated value of goods or services, if provided.

Example: If you donate $500 to a charity and receive a $50 event ticket in return, the acknowledgment must state the ticket’s value, reducing the deductible amount to $450.

Common Errors to Avoid

- Incomplete Acknowledgments: Missing critical details like the donation date or value of goods received.

- Late Documentation: Failing to secure acknowledgment before filing taxes.

- Relying on Bank Records Alone: While helpful, bank records alone do not meet IRS requirements for more significant donations.

Pro Tips for Compliance

- Double-check acknowledgment letters for accuracy before filing taxes.

- Ensure the charity is a qualified organization under IRS rules.

- Keep documentation for at least three years in case of an audit.

“Accurate and thorough documentation ensures your charitable contributions are fully recognized, maximizing your tax benefits and protecting you from compliance issues.”

Special Considerations for Non-Cash Donations

Special Considerations for Non-Cash Donations

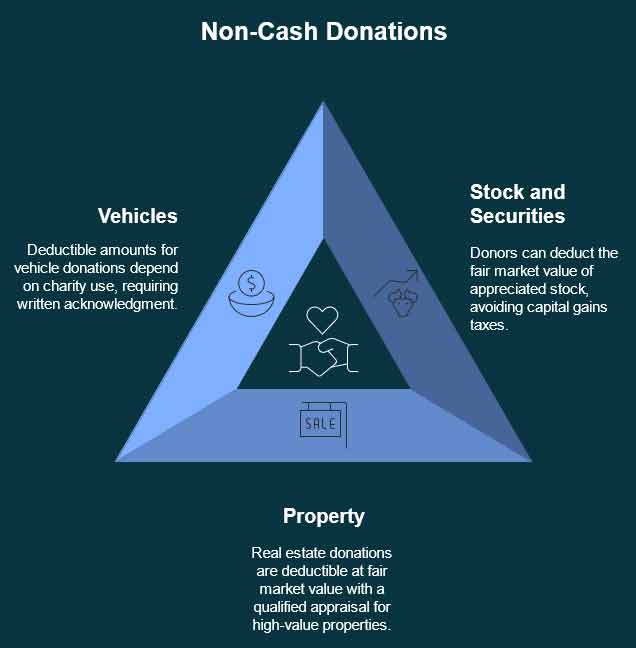

Tax Rules for Donating Stock, Property, and Vehicles

Non-cash donations, such as stock, real estate, and vehicles, offer unique tax benefits but come with specific rules:

- Stock and Securities:

- Donors can deduct the fair market value of appreciated stock held for over a year.

- This strategy avoids capital gains taxes, providing dual tax benefits.

- Property:

- Real estate donations are deductible at fair market value if held long-term.

- Donors must obtain a qualified appraisal for property valued over $5,000.

- Vehicles:

- Deductible amounts depend on how the charity uses the vehicle:

- Total sale price if sold.

- Fair market value if used directly by the charity.

- A written acknowledgment from the charity is mandatory.

- Deductible amounts depend on how the charity uses the vehicle:

Example: Donating $10,000 in appreciated stock avoids $2,000 in capital gains taxes (assuming a 20% tax rate) while providing a $10,000 deduction.

Guidelines for Donating Clothing and Household Goods

Charitable contributions of clothing and household items are deductible under these conditions:

- Items must be in “good” or “better” condition.

- Fair market value is used to determine the deductible amount.

- For donations exceeding $500 in value, taxpayers must complete Form 8283.

Pro Tip: Use tools like thrift store pricing guides to estimate fair market value accurately.

Pro Tip: Use tools like thrift store pricing guides to estimate fair market value accurately.

Donating from IRAs for Taxpayers Over 70½

For individuals aged 70½ or older, IRA distributions offer a strategic way to make tax-free donations:

- Qualified Charitable Distributions (QCDs):

- Up to $100,000 annually can be donated directly to charities.

- QCDs satisfy required minimum distributions (RMDs), reducing taxable income.

- Limitations:

- Contributions must be made directly from the IRA to the charity.

- Not applicable for 401(k) or other retirement plans unless rolled into an IRA first.

Using QCDs, older taxpayers can reduce their tax burden while supporting charitable causes.

Strategies to Maximize Charitable Tax Savings

Strategies to Maximize Charitable Tax Savings

Tips for Strategic Giving

- Bundle Donations:

- Combine several years’ contributions into one tax year to surpass the standard deduction threshold.

- This is particularly effective for donors who itemize deductions periodically.

- Align Giving with Tax Planning:

- Make large donations in high-income years to offset taxes.

- Use Colorado-specific credits for added savings.

Advantages of Donor-Advised Funds (DAFs)

Donor-advised funds are a flexible, tax-efficient option for managing charitable giving:

- How They Work:

- Donors make a lump-sum contribution to the DAF, receiving an immediate tax deduction.

- Funds can then be distributed to charities over time.

- Benefits:

- Simplifies recordkeeping by consolidating donations.

- Allows for long-term planning and strategic contributions.

Example: Donating $50,000 to a DAF provides an immediate deduction while enabling annual gifts of $10,000 to five charities over five years.

Best Practices for Donating Appreciated Assets

Best Practices for Donating Appreciated Assets

- Identify High-Growth Assets:

- Stocks or property with significant appreciation offer the best tax benefits.

- Avoid Capital Gains Taxes:

- Donate the asset directly instead of selling it first.

- Work with a Professional:

- Ensure appraisals and valuations meet IRS standards.

“Strategic giving through appreciated assets amplifies your contribution’s impact while maximizing tax savings.”

Real-Life Examples and Case Studies

Tax Savings Examples for Common Donation Scenarios

- Child Care Contribution Credit Example:

- A Denver resident donates $1,000 to a qualified childcare program.

- Tax benefits include:

- State Tax Credit: $500 (50% of the donation).

- Federal Tax Savings: $153 (assuming a 22% tax bracket).

- State Tax Savings: $23.

- Total Tax Savings: $676.

- Net Cost to Donor: $324.

- Homeless Contribution Tax Credit Example:

- A business donates $5,000 in stock to a qualified homeless program.

- Tax benefits include:

- State Tax Credit: $1,250 (25% of the donation).

- Capital Gains Tax Avoidance: $1,000 (20% of $5,000 appreciation).

- Total Savings: $2,250.

Real-Life Stories of Denver Donors

- Maximizing Deductions with Bundling:

- Sarah, a high-income earner in Denver, bundles three years of donations into one tax year. She surpasses the standard deduction threshold by contributing $20,000 to a donor-advised fund and gains an immediate tax benefit.

- Over the following years, Sarah distributes funds to local charities, optimizing her tax savings while supporting causes close to her heart.

- Leveraging IRA Distributions:

- John, aged 72, donates $15,000 directly from his IRA as a Qualified Charitable Distribution (QCD).

- This contribution satisfies his Required Minimum Distribution (RMD) and lowers his taxable income, saving him over $3,000 in taxes while benefiting a local nonprofit.

Insights from Tax Professionals

Insights from Tax Professionals

- On Strategic Giving:

- “Colorado’s tax credits are incredibly generous but underutilized. Donors should focus on programs like the Child Care Contribution Credit for maximum impact,” says Denver-based CPA Jane Doe.

- On Documentation:

- “Keep detailed records and consult with a tax professional to ensure compliance. Missing a small detail could result in losing a deduction,” advises John Smith, a tax attorney.

- On Appreciated Assets:

- “Donating appreciated stocks is one of the smartest ways to give. You bypass capital gains taxes while claiming a full deduction at fair market value,” notes financial advisor Mary Taylor.

Maximize Tax Deductible Donations Conclusion

The Dual Impact of Charitable Giving

Charitable giving is a meaningful way to support Denver’s community and a financially savvy strategy for donors. Programs like the Child Care Contribution Credit and Homeless Contribution Tax Credit amplify the value of donations, allowing individuals and businesses to make a more significant impact.

The Value of Understanding Tax Benefits

Donors can maximize their contributions by leveraging tax credits, deductions, and strategic giving options like donor-advised funds while minimizing costs. Proper planning and documentation are essential to unlocking these benefits.

Call to Action

Call to Action

Denver donors have a unique opportunity to support local causes while enjoying substantial tax advantages. Consult a tax professional or financial advisor to ensure you make the most of your charitable contributions. Your generosity fuels a more robust community—and with the right strategies, it benefits you, too.

Additional Resources for Tax Deductable Donations

- Colorado Department of Revenue:

- Qualified Nonprofits in Women’s